Washington, D.C. 20549

Applied Minerals, Inc.

Persons who are to respond to the collection of information contained in this form are not

required to respond unless the form displays a currently valid OMB control number.

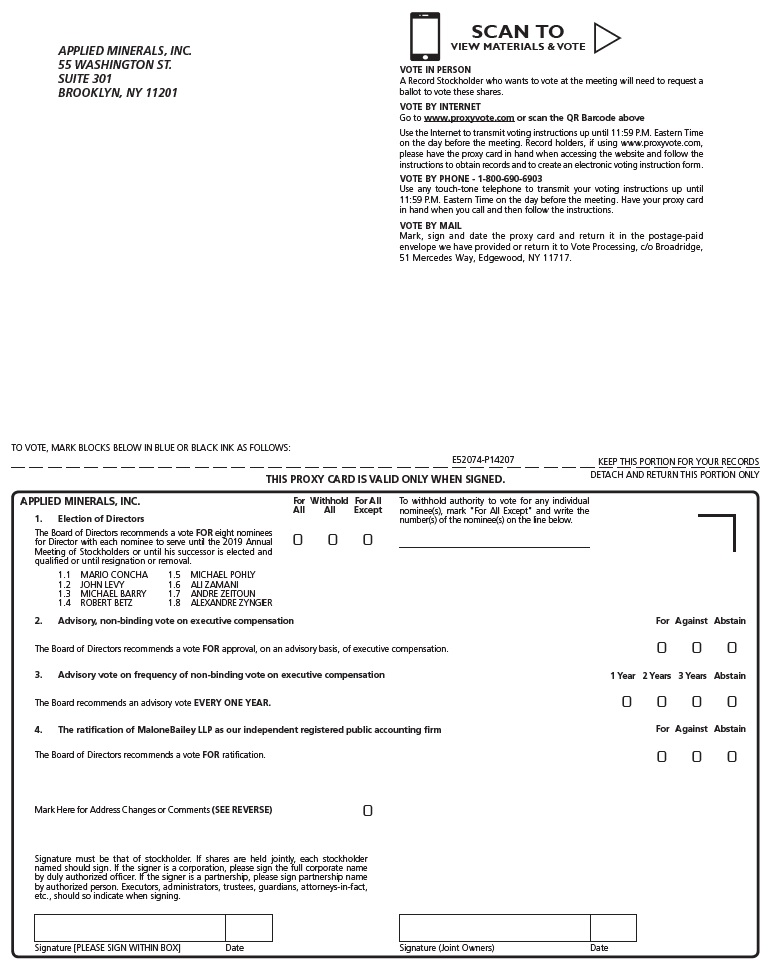

We invite you to attend the Annual Meeting of Applied Minerals, Inc., which will be held at 2:00 PM Eastern on December 6, 20184, 2019 at 304 Hudson300 Vesey Street, Third12th Floor, New York, NY 10013.N.Y. 10282. Doors open at 1:30 PM. The meeting will be webcast and you can listen to it by logging on at PM Eastern.www.virtualshareholdermeeting.com/AMNL2018. The attached Notice of Annual Meeting and Proxy Statement give details of the business to be conducted at the meeting.

You can use the Internet or telephone to transmit voting instructions up until 11:59 P.M. Eastern Time on December 5, 2018.3, 2019. Internet and telephone voting facilities for record holders are available 24 hours a day. If you do not have the 16-digit control number, you may contact Broadridge Shareholder Services at 877-830-4936 or shareholder@broadridge.com.

The Board of Directors of the Company is soliciting the proxy accompanying this Proxy Statement. Proxies may be solicited by officers, directors, and employees of the Company, none of whom will receive any additional compensation for their services. These solicitations may be made personally or by mail, facsimile, telephone, messenger, email, or the Internet. The Company will pay persons holding shares of Common Stock in their names or in the names of nominees, but not owning such shares beneficially (such as brokerage houses, banks, and other fiduciaries) for the expense of forwarding solicitation materials to their principals. The Company will pay all proxy solicitation costs.

To reduce costs and reduce the environmental impact of our Annual Meeting, a single proxy statement, annual report, and Form 10-Q for the three months ended June 30, 2018 will be delivered in one envelope to certain stockholders having the same last name and address and to individuals with more than one account registered at our transfer agent with the same address, unless contrary instructions have been received from an affected stockholder. Stockholders participating in householding will continue to receive separate proxy cards. If you are a registered stockholder and would like to enroll in this service or receive individual copies of this year’s and/or future proxy materials, please contact our transfer agent, Broadridge Corporate Issuer Solutions, by phone at (800) 542-1061 or mail at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. If you are a beneficial stockholder, you may contact the broker or bank where you hold the account.

The presence of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting (87,756,775(175,513,549 shares), in person or represented by proxy, is necessary to constitute a quorum. Abstentions and “broker non-votes” are counted as “present and entitled to vote” for purposes of determining a quorum.

Eight directors are to be elected at the Annual Meeting to hold office until the next Annual Meeting of Stockholders or until their respective successors are elected and qualified or until such director's earlier resignation or removal.

The Board of Directors expects that each of the nominees will be available for election, but if any of them is unable to serve at the time the election occurs, the proxy will be voted for the election of another nominee designated by our Board.

If, for any reason, the directors are not elected at an Annual Meeting, they may be elected at a special meeting of stockholders called for that purpose in the manner provided by the By-Laws of the Company (“By-Laws”).

All proxies solicited by the Company, whether received by means of a proxy card, telephone, or the Internet, will be voted, and where a choice is made with respect to a matter to be voted on, the shares will be voted in accordance with the specifications so made.

Except for broker non-votes, if a proxy is submitted without indicating voting instructions on Proposal 2 (Say-on-Pay), Proposal 3 (advisory vote(amendment to approve the frequencyCertificate of the advisory vote to approve the compensation of the company’s named executive officers)Incorporation), or Proposal 4 (ratification of independent auditor), it will be deemed to grant authority to vote FOR the Proposal(s) as to which no instruction is given.

Beneficial owners will receive a voting instruction form or other means, as specified by the broker or custodian, to instruct your broker, custodian, or other fiduciary how to vote. Beneficial owners may instruct the broker or custodian or other fiduciaries how to vote the shares through the voting instruction form or other means. If you wish to vote the shares you own beneficially at the meeting, you must request and obtain from your broker or other custodian and bring to the meeting, a “legal proxy” (a written authorization from the broker or custodian authorizing you to vote at the meeting).

Employees of the Company will tabulate the shares present at the meeting and the votes cast. We expect to report the final vote tabulation on a Form 8-K filed with the SEC within four business days of the Annual Meeting.

The directors will be elected by a plurality of the votes cast, meaning the directors receiving the largest number of “FOR” votes will be elected to the open positions. The Company’s By-Laws contain advance notice provisions for nominations for director by stockholders. If a stockholder makes a nomination that is not made in accordance with such advance-notice provisions, the nomination may not be voted on at the meeting. As of the date of this proxy statement, the date for stockholder to comply with the advance notice provisions, and thus to be eligible to make a nomination at the meeting, has passed

If you are the beneficial owner of shares held by a broker or other custodian and you instruct the broker or custodian to vote but choose not to provide instructions as to one or more ballot items, your shares are referred to as “uninstructed shares” as to the ballot items on which you do not provide instructions. Whether your broker or custodian has the discretion to vote these shares on your behalf depends on the ballot item. See table below. If the broker or custodian has discretion, the broker or custodian may vote as it chooses. If the broker or custodian does not have discretion to vote on a proposal, the shares will not be voted on that proposal and are referred to as “broker non-votes” as to that proposal.

Shares represented by proxies submitted without instructions or with instructions only on some issues or with withhold or absentions as well as shares represented by broker non-votes will be included in the number of shares present at the Annual Meeting to determine whether a quorum is present.

The following table summarizes the votes required for passage of each proposal, the effect of abstentions on the voting of shares, and the effect of uninstructed shares held by brokers or other custodians on the voting of such shares.

Under the Company’s By-Laws, if other matters in addition to those listed in the Notice are properly presented at the Annual Meeting for consideration, the persons appointed as proxies by the Board of Directors (the persons named on your proxy card if you are a stockholder of record) will have the discretion to vote the proxies they hold on those matters for you and will follow the instructions of the Board of Directors. However, the Company’s By-Laws contain advance notice provisions for proposals to be made by stockholders. If a stockholder offers a proposal for a vote that is not made in accordance with such advance-notice provisions, the proposal may not be voted on at the meeting. As of the date of this proxy statement, the date for a stockholder to comply with the advance notice provisions, and thus to be eligible to make a proposal at the meeting, has passed.

At this Annual Meeting, eight directors are to be elected, and each director to serve until the next Annual Meeting of Stockholders or until such director’s successor is elected and qualified or such director resigns or is removed. The Board of Directors’ nominees for the Board of Directors are:

Mr. Concha is the President of Mario Concha and Associates, LLC, a firm providing consulting services to senior executives and members of boards of directors. In addition to providing consulting services, heHe serves on the board of the National Association of Corporate Directors, Atlanta Chapter. He has served as a director of Arclin, Ltd., a manufacturer of specialty resins, and Auro Resources, Corp, a mineral exploration company with holdings in Colombia’s gold region. Prior to founding Mario Concha and Associates in 2005, Mr. Concha was an officer of Georgia Pacific Corporation and president of its Chemical Division from 1998 to 2005. Prior to Georgia Pacific, Mr. Concha participated in the formation of GS Industries, a manufacturer of specialty steels for the mining industry, through a leveraged buyout of Armco Inc’sInc.’s Worldwide Grinding Systems Division. He then served as President of its International Division from 1992 to 1998. From 1985 to 1992, Mr. Concha was Vice President-International for Occidental Chemical Corporation. Prior to Occidental Chemical, he served in several senior management positions at Union Carbide Corporation in the United States and overseas.

Mr. Concha is a graduate of Cornell University with a degree in Chemical Engineering. He has attended the Advanced Management Program at the University of Virginia's Darden School of Business and the NACD-ISS accredited Director's College at the University of Georgia's Terry College of Business. He is a member of the National Association of Corporate Directors, the American Chemical Society, and the American Institute of Chemical Engineers.

John F. Levy, Vice Chairman and Director

Since May 2005, Mr. Levy has served as the Chief Executive Officer of Board Advisory, a consulting firm that advises public companies in the areas of corporate governance, corporate compliance, financial reporting, and financial strategies.Additionally, Mr. Levy currently serves as the Chief Executive Officer of Sticky Fingers Restaurant, LLC, a South Carolina based barbeque restaurant chain, and has held this position since August 2019. Mr. Levy previously served as a business consultant with Sticky Fingers Restaurants, LLC from February 2019 to August 2019 when he assumed his current role with the company. In addition to his service on theApplied Minerals, Inc. board of directors, of three public companies including Applied Minerals. Mr. Levy has been a director, chairman of the Audit Committee, and a member of the Governance and Nominating Committee, of Washington Prime Group, a Real Estate Investment Trust, since 2016. Mr. Levy has beenwas a director, chairman of the Governance and Nominating Committee, and a member of the Audit and Compensation Committees of Takung Art Co., Ltd., an operator of an electronic online platform for artists, art dealers and art investors to offer and trade in ownership units over valuable artwork since 2016.from February 2016 to June 2019. He was a director of China Commercial Credit, a publicly held Chinese micro-lender, from 2013 to 2016. He was a director and audit committee member of Applied Energetics, Inc. (AERG), a publicly held company that specialized in the development and application of high power lasers, high voltage electronics, advanced optical systems and energy management systems technologies from 2009 to 2016.

From 2006 to 2013, Mr. Levy was a director and chair of the Audit Committee of Gilman Ciocia, Inc., a publicly traded financial planning and tax preparation firm and served as lead director from 2007 to 2013. From 2010 to 2012, he served as director of Brightpoint, Inc., a publicly traded company that provides supply chain solutions to leading stakeholders in the wireless industry. From 2008 through 2010, he served as a director of Applied Natural Gas Fuels, Inc. (formerly PNG Ventures, Inc.). From 2006 to 2010, Mr. Levy served as a director and Audit Committee chairman of Take Two Interactive Software, Inc., a public company that is a global developer and publisher of video games best known for the Grand Theft Auto franchise. Mr. Levy is a frequent speaker on the roles and responsibilities of Board members and audit committee members. He has authored The 21st Century Director: Ethical and Legal Responsibilities of Board Members, Acquisitions to Grow the Business: Structure, Due Diligence, Financing, Ethics and Sustainability: A 4-way Path to Success, Finance and Innovation: Reinvent Your Department and Your Company, Predicting the Future: 21st Century Budgets and Projections and Heartfelt Leadership: How Ethical Leaders Build Trusting Organizations. All courses have been presented to state accounting societies.

Mr. Levy is a Certified Public Accountant with nineseveral years experience with the national public accounting firms of Ernst & Young, Laventhol & Horwath, and Grant Thornton.experience. Mr. Levy hasis a B.S. degree in economics fromgraduate of the Wharton School of the University of Pennsylvania, and received his M.B.A.MBA from St. Joseph's University (PA).in Philadelphia. Mr. Levy has completed the National Association of Corporate Directors’ Board Leadership Fellow program of study.

Mr. Zamani holds a B.S. in Economics from the Wharton School at the University of Pennsylvania, where he graduated magna cum laude.

Mr. Zyngier has been the Managing Director of Batuta Advisors since founding it in August 2013. The firm pursues high return investment and advisory opportunities in the distressed and turnaround sectors. Mr. Zyngier has over 20 years of investment, strategy, and operating experience. He is currently a director of Atari SA, AudioEye Inc., Torchlight Energy Resources IncInc. and certain other private entities. Before starting Batuta Advisors, Mr. Zyngier was a portfolio manager at Alden Global Capital from February 2009 until August 2013, investing in public and private opportunities. He has also worked as a portfolio manager at Goldman Sachs & Co. and Deutsche Bank Co. Additionally, he was a strategy consultant at McKinsey & Company and a technical brand manager at Procter & Gamble. Mr. Zyngier holds an MBA in Finance and Accounting from the University of Chicago and a BS in Chemical Engineering from UNICAMP in Brazil.

Mr. Levy was originally recommended for election as director by David Taft, at the time a significant stockholder and later a director. Mr. Zeitoun was initially elected a director pursuant to the terms of his agreement to become CEO. Mr. Concha was originally recommended by Mr. Levy. Mr. Betz was originally recommended by Mr. Concha. Mr. Zamani was originally recommended security holders. Mr. Zyngier was recommended by Mr. Zeitoun, formerly a director and CEO and President. Mr. Scott was recommended by Mr. Zeitoun. Messrs. Barry and Pohly were appointed pursuant to director nomination agreements with the holders of the Series A and the Series 2023 Notes, respectively.

The Company entered into an director nomination agreement (“Samlyn Director Nomination Agreement’) in 2011 in connection with a $10 million investment in the Company with Samlyn Onshore Fund, LP, a Delaware limited partnership, and Samlyn Offshore Master Fund, Ltd., a Cayman Islands exempted company (together the “Samlyn Funds”). Subject to the terms and conditions of the Samlyn Director Nomination Agreement, until the occurrence of a Termination Event (as defined in the Samlyn Director Nomination Agreement), the Samlyn Funds jointly have the right to designate one person to be nominated for election to the Board. The Samlyn Funds have exercised the right to designate a person by designating Michael Barry, the General Counsel and Chief Compliance Officer of Samlyn Capital, LLC, Mr. Barry is currently serving as a director and is a Board nominee for election as a director at the 20182019 Annual Meeting

The Company entered into a director nomination agreement (“2023 Director Nomination Agreement’Agreement”) in 2017 with the Holders of the 10% PIK Election Convertible Notes Due 2023 (“2023 Holders”). Subject to the terms and conditions of the 2023 Director Nomination Agreement, the 2023 Holders have the right the right to designate one person to be nominated for election to the Board. The 2023 Holders exercised that right to designate in 2018 by designating Michael Pohly, who at the time was Portfolio Manager and Sector Head for Credit, Currencies and Commodities at Kingdon Capital Management LLC. He is now the founder and Managing Member of Goshawk Partners LLC. Mr. Pohly is currently serving as a director and is a board nominee for election as a director at the 20182019 Annual Meeting.

Messrs. Concha, Levy, Barry, Betz, Pohly, Scott, Zamani and Zyngier are deemed to be independent for purposes of the Board under the independence standards of Nasdaq, which the Company uses to determine independence, and under the enhanced independence standards of Section 10A-3 of the Securities Exchange Act. They are also deemed to be outside directors under the standards of Section 162(m) of the Internal Revenue Code.

The Board oversees management’s evaluation and planning for risks that the Company faces. Management regularly discusses risk management at its internal meetings and reports to the Board and/or Operations Committee those risks that it thinks are most critical and what it is doing in response to those risks. The Board exercises oversight by reviewing key strategic and financial plans with management at each of its regular quarterly meetings as well as at certain special meetings. The Board’s risk oversight function is coordinated under the leadership of the independent Chair of the Board and the Board believes that this oversight is enhanced by the separation of the role of Chair from CEO.

We have adopted a Code of Conduct and Ethics for our Chief Executive Officer and our senior financial officers. A copy of our Code of Conduct and Ethics is posted on our website at www.appliedminerals.com and can be obtained at no cost, by telephone at (212) 226-4265 or via mail by writing to Applied Minerals, Inc., 55 Washington Street, Brooklyn, NY 11201. We believe our Code of Conduct and Ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; to provide full, fair, accurate, timely and understandable disclosure in public reports; to comply with applicable laws; to ensure prompt internal reporting of code violations; and to provide accountability for adherence to the Code.

The following sets forth the standing Committees of the Board and membership of the committees. The charters of the committees are available at the Company’s website, appliedminerals.com. The Board of Directors has determined that all committee members are independent under the independence definition used by NASDAQ except for Mr. Zeitoun.Concha.

The Audit Committee satisfies the definition of Audit Committee in Section 3(a)(58)(A) of the Securities Exchange Act of 1934.

There is a special committee of the Board appointed to deal with the disposition of the funds received from the sale of five waste piles on August 2018. The Committee consists of Messrs. Concha, Levy, Betz, Zamani, and Zyngier.

The Board of Directors has determined that Mr. Zamani is an Audit Committee Financial Expert as the term is defined in the rules of the Securities and Exchange Commission.

The Governance and Nominating Committee does not have a set process for identifying and evaluating nominees for director and does not have any specific minimum requirements that must be met by any committee-recommended nominee for a position on the Board of Directors. Characteristics expected of all directors include integrity, high personal and professional ethics, sound business judgment, and the ability and willingness to commit sufficient time to the Board. In evaluating the suitability of individual Board members, the Board takes into account many factors, including general understanding of marketing, finance, and other disciplines relevant to the success of a publicly-traded company in today's business environment; understanding of the Company's business; educational and professional background; and personal accomplishment. The Board evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best promote the success of the Company's business and represent stockholder interests through the exercise of sound judgment. In determining whether to recommend a director for re-election, the Governance and Nominating Committee also considers the director's past attendance and the results of the most recent Board self-evaluation.

The Board does not have a policy relating to diversity in connection with the identification or selection of nominees and has not considered the issue.

The Board will consider director candidates recommended by any stockholder. In evaluating candidates recommended by our stockholders, the Board of Directors has no set process for evaluating nominees, and the criteria would include the ones set forth above that are applied to nominees nominated by the Board. Any stockholder recommendations for director nominees proposed for consideration by the Board should include the candidate's name and qualifications for service as a Board member, a document signed by the candidate indicating the candidate's willingness to serve, if elected, and evidence of the stockholder's ownership of Company Common Stock and should be addressed in writing to the Chairman, Applied Minerals, Inc., 55 Washington Street, Suite 301 Brooklyn, NY 11201.

There have been no changes in the procedures by which stockholders may recommend candidates for director.

The Governance and Nominating Committee has a charter and it is posted on the Company's website.

In connection with their investment of $10 million in 2011, Samlyn Onshore Fund, LP, a Delaware limited partnership, and Samlyn Offshore Master Fund, Ltd., a Cayman Islands exempted company (collectively, the “Samlyn Entities”) were granted the joint right to designate one person (the “Initial Nominee”) to be nominated for election to the Board and the Board of Directors must use commercially reasonable efforts to cause the election or appointment, as the case may be, of such nominee as a director of the Company.

If any nominee is jointly designated by the Samlyn Entities at a time (A) at which such nominee cannot be included in the proxy statement prepared by management of the Company in connection with the soliciting of proxies for a meeting of the stockholders of the Company called with respect to the election of directors or (B) after which a meeting of the stockholders has been held with respect to the election of directors (collectively, the “Interim Period”) or (ii) is nominated for election to the Board but not elected by the stockholders of the Company for any reason whatsoever, the Board shall increase the number of members serving on the Board by one and the Samlyn Entities shall be entitled to promptly designate a nominee, who shall be appointed by the Board to fill the additional member position promptly.

If the Samlyn Entities, together with their respective affiliates, cease to beneficially own at least 9,700,000 shares of Common Stock, the rights of the Samlyn Entities described above shall terminate automatically (the “Termination Event”). As promptly as practicable following the Termination Event, at the request of the Board, the Samlyn Nominee shall cause such Nominee to execute and deliver a letter of resignation to the Company, which resignation shall be effective immediately with respect to the Company and, if applicable, any subsidiary of the Company for which such Nominee serves as a director, manager or other similar position.

The Samlyn Funds exercised the right to designate a person by designating Michael Barry, the General Counsel and Chief Compliance Officer of Samlyn Capital, LLC. Mr. Barry was appointed to the Board in April 2018. At his direction, Mr. Barry’s compensation as a director is paid to the Samlyn Funds.

The Company has entered into a director nomination agreement (“2023 Director Nomination Agreement’) in 2017 with the Holders of the 10% PIK Election Convertible Notes Due 2023 (“2023 Holders”). Subject to the terms and conditions of the 2023 Director Nomination Agreement, the 2023 Holders have the right to designate one person to be nominated for election to the Board. The 2023 Holders have designated Michael Pohly, who at the time was Portfolio Manager and Sector Head for Credit, Currencies and Commodities at Kingdon Capital Management LLC and is now the founder and managing member of Goshawk Partners LLC, as a director and Mr. Pohly has been appointed as a director. AtPrior to March 31, 2019, at his direction, Mr. Pohly’s compensation as a director iswas paid to M. Kingdon Offshore Master Fund, L.P. Under the 2023 Director Nomination Agreement, if a nominee (i) is designated by the at a time (A) at which such nominee cannot be included in the proxy statement prepared by management of the Company in connection with the soliciting of proxies for a meeting of the stockholders of the Company called with respect to the election of Directors or (B) after which a meeting of the stockholders has been held with respect to the election of Directors or (ii) is nominated for election to the Board but not elected by the stockholders of the Company for any reason whatsoever (including, without limitation, such nominee’s death, disability, disqualification or withdrawal as a nominee), the Board shall increase the number of members serving on the Board by one, if appropriate, and the noteholders shall be entitled to promptly designate a nominee by written notice to the Company, who shall be appointed by the Board to fill such additional member position promptly. Such rights expire upon the occurrence of a Termination Event as defined. A Termination Event occurs if the 2023 Holders, together with their respective Affiliates, cease to Beneficially Own at least 80 per cent of the Series 2023 Notes that have been issued in the aggregate, whether as a result of dilution, transfer, conversion, or otherwise.

The Compensation Committee is required to meet at least twice a year. The Committee charter states that the Committee will have the resources and authority necessary to discharge its duties and responsibilities and the Committee has sole authority to retain and terminate outside counsel, compensation consultants, or other experts or consultants, as it deems appropriate, including sole authority to approve the fees and other retention terms for such persons.

| | (The CEO may not be present during deliberations or voting concerning the CEO's compensation.) | 3. | Other Executive Officer Compensation. |

| 3.

a. | Other Executive Officer Compensation.

|

| | | | a.

| Oversee an evaluation of the performance of the Company's executive officers and approve the annual compensation, including salary and incentive compensation, for the executive officers. | | | |

| b. | Review the structure and competitiveness of the Company’s executive officer compensation programs considering the following factors: (i) the attraction and retention of executive officers; (ii) the motivation of executive officers to achieve the Company’s business objectives; and (iii) the alignment of the interests of executive officers with the long-term interests of the Company’s stockholders. |

| c. | | | c.

| Review and approve compensation arrangements for new executive officers and termination arrangements for executive officers. |

| 4. | General Compensation Oversight. Monitor and evaluate matters relating to the compensation and benefits structure of the Company as the Committee deems appropriate, including: |

| a. | | | a.

| Provide guidance to management on significant issues affecting compensation philosophy or policy. | | | |

| b. | Provide input to management on whether compensation arrangements for Company executives incentivize unnecessary and excessive risk taking. | | | |

| c. | Review and approve policies regarding CEO and other executive officer compensation. |

| 5. | Equity and Other Benefit Plan Oversight. |

| a. | | | a.

| Serve as the committee established to administer the Company’s equity-based and employee benefit plans and perform the duties of the committee under those plans. The Compensation Committee may delegate those responsibilities to senior management as it deems appropriate as limited by the plans. |

| b. | Appoint and remove plan administrators for the Company’s retirement plans for the Company’s employees and perform other duties that the Board may have with respect to the Company’s retirement plans. |

| 6. | Compensation Consultant Oversight. |

| a. | | | a.

| Retain and terminate compensation consultants that advise the Committee, as it deems appropriate, including approval of the consultants’ fees and other retention terms and ensure that the compensation consultant retained by the Committee is independent of the Company. |

The Compensation Committee may form and delegate authority to subcommittees and may delegate authority to one or more designated members of the committee. The Committee may delegate to the Chief Executive Officer authority to make grants of equity-based compensation in the form of rights or options to eligible officers and employees who are not executive officers, such authority including the power to (i) designate officers and employees of the Company or any of its subsidiaries to be recipients of such rights or options created by the Company, and (ii) determine the number of such rights or options to be received by such officers and employees; provided, however, that the resolution so authorizing the Chief Executive Officer shall specify the total number of rights or options the Chief Executive Officer may so award. If such authority is delegated, the Chief Executive Officer shall regularly report to the Committee grants so made. The Committee may revoke any delegation of authority at any time. The Compensation Committee has not delegated any authority to the Chief Executive Officer.

For purposes of determining CEO compensation for 2014, 2015, and 2016, the Compensation Committee engaged a compensation consultant, Compensation Resources Inc., to conduct studies of the competitive levels of compensation for comparable positions among similar publicly traded companies. The Compensation Committee did not use a compensation consultant in connection with 2017 or 2018 CEO compensation. A copy of the compensation committee charter is available at www.appliedminerals.com. Compensation of Policies and Practices as They Relate To Risk Management

The Company does not believe that its compensation policies and practices are reasonably likely to have a material adverse effect on the Company as they relate to risk management practices and risk-taking incentives

Compensation Committee Interlocks and Insider Participation

| Compensation Committee Interlocks and Insider Participation | |

None of the members of the Compensation Committee (Messrs. Concha, Betz, Levy) are or were (except for Mr. Concha during the period from his appointment as CEO and President on September 9, 2019 until the Board meeting on September 26, 2019 when he left the Compensation Committee) officers or employees of the Company and none (and none of the members of their immediate families) had in 2016 and 2017 any relationships of the type described in Item 404 of Regulation S-K. There have not been any interlocking relationships of the type described in Item 407(e)(4)(iii) of Regulation S-K. Mr. Zeitoun participated in deliberations of the Board of Directors concerning executive officer compensation other than his own. Stockholder Communications to the Board of Directors

| Stockholder Communications to the Board of Directors | |

Stockholders may communicate with the Board of Directors by sending an email or a letter to Applied Minerals, Inc. Board of Directors, c/o President, 55 Washington Street, Brooklyn, New York 11201. The President will receive the correspondence and forward it to the individual director or directors to whom the communication is directed or to all directors if not directed to one or more specifically.

Part 3 Information concerning Executive Officers and Their Compensation Named Executive Officers

The Named Executive Officers of the Company are : Name | Age

| Age | | Position | | | | | | Andre Zeitoun

Mario Concha | 45

| 79 | | President, CEO, Chairman of the Board and Director | | | | | | Christopher Carney | 48

| 49 | | Chief Financial Officer; Vice President, Business Development | | | | | | William Gleeson | 75

| 76 | | General Counsel and Secretary |

Marion Concha.Mr. Concha became President and CEO on September 9, 2019

Andre Zeitoun Biographical information about. Mr. Zeitoun appears above under “Information about Directors”was a director, and CEO and President until September 9, 2019, when he resigned such positions. Christopher T. Carney From February 2009 through May 2012, Mr. Carney was the Interim Chief Financial Officer of the Company. From May 2012 through August 2015, Mr. Carney was a VP of Business Development for the Company. Mr. Carney was appointed Chief Financial Officer of the Company in August 2015 when the previous Chief Financial Officer resigned. He retained his position as Vice President of Business Development. From March 2007 until December 2008, Mr. Carney was an analyst at SAC Capital/CR Intrinsic Investors, LLC, a hedge fund, where he evaluated the debt and equity securities of companies undergoing financial restructurings and/or operational turnarounds. From Marchh 2004 until October 2006, Mr. Carney was a distressed debt and special situations analyst for RBC Dain Rauscher Inc., a registered broker-dealer. Mr. Carney graduated with a BA in Computer Science from Lehman College and an MBA in Finance from Tulane University. William Gleeson. Mr. Gleeson was appointed General Counsel and Secretary in September, 2011.\2011. Prior thereto he was a partner in the law firm K&L Gates LLP for more than five-years, specializing in securities, corporate, and M&A law. All officers serve at the pleasure of the Board. SUMMARY COMPENSATION TABLE

Name and Principal Position | Year | | Salary ($) | | | Cash Bonus ($) | | | Option Award ($) (1) | | | Total ($) | | Andre Zeitoun | 2017 | | | 350,000 | | | | 270,000 | (2)(3) | | | 614,596 | (4) | | | 1,234,596 | | | 2016 | | | 350,000 | | | | 150,000 | (2) | | | | | | | 500,000 | | | 2015 | | | 600,000 | | | | 300,000 | (5) | | | 50,000 | (5) | | | 950,000 | | | | | | | | | | | | | | | | | | | | Christopher Carney (6) | 2017 | | | 135,000 | (7) | | | 30,000 | (3) | | | 246,676 | (7)(8) | | | 411,676 | | | 2016 | | | 181,250 | (7) | | | - 0 - | | | | 40,500 | (8) | | | 221,750 | | | 2015 | | | 200,000 | | | | 37,500 | (9) | | | 54,062 | (9)(10) | | | 291,562 | | | | | | | | | | | | | | | | | | | | William Gleeson (5) (8) | 2017 | | | 250,000 | | | | 30,000 | (3) | | | 193,471 | (8) | | | 473,471 | | | 2016 | | | 250,000 | | | | - 0 - | | | | - 0 - | (8) | | | 250,000 | | | 2015 | | | 300,000 | | | | 37,500 | (9) | | | 37,500 | (9) | | | 375,000 | |

Name and Principal Position | | Year | | Salary ($) | | | Cash Bonus ($) | | | Option Award ($) (1) | | | Total ($) | | | Andre M. Zeitoun | | 2018 | | | 350,000 | | | | 75,000 | (2) | | | -0- | | | | 425,000 | | | | | 2017 | | | 350,000 | | | | 270,000 | (3)(4) | | | 614,596 | (5) | | | 1,234,596 | | | | | 2016 | | | 350,000 | | | | 150,000 | (2) | | | -0- | | | | 500,000 | | | | | | | | | | | | | | | | | | | | | | | Christopher Carney (6) | | 2018 | | | 200,000 | | | | 20,000 | (2) | | | -0- | | | | 220,000 | | | | | 2017 | | | 135,000 | (7) | | | 30,000 | (4) | | | 246,676 | (8) | | | 411,676 | | | | | 2016 | | | 181,250 | (7) | | | -0- | | | | 40,500 | (7) | | | 221,750 | | | | | | | | | | | | | | | | | | | | | | | William Gleeson | | 2018 | | | 250,000 | | | | 20,000 | (2) | | | -0- | | | | 270,000 | | | | | 2017 | | | 250,000 | | | | 30,000 | (4) | | | 193,471 | (8) | | | 473,471 | | | | | 2016 | | | 250,000 | | | | -0- | | | | -0- | | | | 250,000 | |

(1) | Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. For additional information, refer to Note 10 to the Notes to Consolidated Financial Statements found in Item 8, Part II of the Company’s Annual Report on Form 10-K.of Form10-K. These amounts reflect the Company’s accounting expense for these awards, and do not correspond to the amount that will be recognized as income by the named executive officers o the amount that will be recognized as a tax deduction by the Company, if any, upon exercise. The options awards were valued using the Black Scholes Option Valuation Model. |

| (2) | On January 2019, the Board of Directors, on the recommendation of the Compensation Committee, granted to Mr. Zeitoun, Mr. Carney and Mr. Gleeson bonuses for service in 2018 of $75,000, $20,000 and $20,000, respectively. The performances were based on performance in 2018 | | | (2)

(3) | Mr. Zeitoun’s revenue-related bonus for 2016 and 2017 was 4% of the first $4 million in revenues up to a bonus of $150,000. | | | (3)

(4) | On December 7, 2017, the Board of Directors, on the recommendation of the Compensation Committee, granted to Mr. Zeitoun a bonus for service in 2017 of $120,000 and in particular for work on amendments to the Series A and Series 2023 Notes and the BASF supply and tolling agreements, and to each of Mr. Carney and Mr. Gleeson a bonus for service in 2017. of $30,000. The bonuses were paidbased on more than satisfactory performance in 2018. 2016. |

(4)

(5) | In DecemberOn August 18, 2017, the Board of Directors granted Mr. Zeitoun options to purchase a time when the market price for the11,910,772 shares of common stock was $.04at $0.06 per share. The Black Scholes value of the options at the grant date was $614,595. The options vest based upon certain performance goals being met by management. During DecemberAt October 15, 2019 options to purchase 5,955,3868,933,079 shares of common stock had vested. The Black Scholes value of the options at August 18, 2017 was $297,800.

| | | (5)

| Mr. Zeitoun's 2015 potential bonus arrangement, as determined in February, 2015, was as follows: the total amount of the possible bonus compensation to Mr. Zeitoun would be $500,000; $200,000 would be based on personal performance metrics; $300,000 would be based on revenue goals. Revenues could include the amount of firm commitment and take-and-pay arrangements. The last $100,000 based on revenue goals would be payable in stock or options. If revenues were below $2 million, no revenue-based bonus would be paid; if between $2 million and $2,999,999, $100,000 in cash would be paid; if between $3 and $3,999,999, a total of $150,000 in cash would be paid; if between $4 million and $4,999,999, a total of $200,000 in cash would be paid; if $5 million or more, a total of $200,000 in cash and $100,000 in stock options would be paid. No determination was made when the performance goals were established as to the probability that the goals would be achieved. Revenues for 2015, including a $5 million take-or-pay agreement for the delivery of iron oxide over a period of 18 months, exceeded $5 million. The amount of the 2015 bonus was determined in 2016 by negotiation between the Board and Mr. Zeitoun in January, 2016.

|

(6) | Mr. Carney has served as Vice President Business Development since 2011. In 2015, he was appointed Chief Financial Officer while retaining his position as Vice President Business Development. His compensation did not change upon being appointed CFO. | |

| |

(7) | Mr. Carney's 2016 salary was at the rate of $200,000 per year for first 7.5 months of 2016 and was at the rate of $150,000 for the final 4.5 months. Mr. Carney agreed to reduce his salary by $50,000 in the period from August 15, 2016 to August 1, 2017 in exchange for options that had a Black Scholes value of approximately $40,500. The options are three-year options, but in accordance with Mr. Carney’s offer to exchange cash for options, the number of options was based on $50,000 divided by the Black Scholes value of five-year options. Mr. Carney’s salary was at a rate of $150,000 per annum for the first 7.5 months of 2017 and then was to increase to a rate of $200,000 per annum for the remaining 4.5 months of 2017. His salary was not increased to a rate of $200,000 per year and Mr. Carney is owed $18,765 in respect thereof relating to 2017. In lieu of a $50,000 salary reduction for twelve (12) months beginning August 16, 2016, Mr. Carney received three-year options to purchase common stock with a Black Scholes value of $40,500. During the first 7.5 months of 2017, $23,625 of the Black Scholes value of the options vested. |

|

| (8) | |

(8)

| In December 2017, the Board of Directors granted to Mr. Carney and Mr. Gleeson options to purchase 4,780,550 shares of common stock and 3,749,440 shares of common stock, respectively, at $0.06 per share. At the date of grant of the options to Messrs. Carney and Gleeson, the Black Scholes values were $246,676 and $193,471, respectively. The options would vest based upon certain performance goals being met by management. During December 2017,At October 15, 2019, options to purchase 2,390,2753,585,413 shares of stock by Mr. Carney and options to purchase 1,874,7202,812,080 shares of common stock by Mr. Gleeson had vested. The Black Scholes values of the options to purchase common stock byBetween August 16, 2017 and December 31, 2017, Mr. Carney deferred approximately $30,000 of salary until the Company’s liquidity situation improves. As of December 31, 2018, Mr. Carney is owed $8,333.33 in accrued and Mr. Gleeson were $223,495 and $175,290, respectively. unpaid salary. |

(9)

There were no perquisites to directors or employees in 2016, 2017, or 2018. The Company’s disclosure controls and procedures are adequate to identify all perquisites being paid to their executive officers and directors. | The 2015 potential bonus arrangement for each Messrs. Carney and Gleeson, as determined in February, 2015, was as follows: the total amount of the possible bonus compensation would be $100,000; $25,000 would be based on personal performance metrics; $75,000 would be based on revenue goals. Revenues could include the amount of firm commitment and take-and-pay arrangements. If revenues exceeded f $5 million or more, a total of $75,000 No determination was made when the performance goals were established as to the probability that the goals would be achieved. Revenues for 2015, including a $5 million take-or-pay agreement for the delivery of iron oxide over a period of 18 months, exceeded $5 million. In January, 2016, the Board determined that although all of the goals we satisfied, the total bonus to be paid to each of Messrs. Carney and Gleeson was $75,000 and up to $37,500 would be paid in cash and the remainder would be paid in options. In March, 2016, Messrs. Carney and Gleeson elected to receive $37,500 of his 2015 bonus in cash and the remaining $37,500 of value in options to purchase common stock of the Company. These options provide the right to purchase 248,344 shares of common stock of the Company at a price of $0.24 per share over a five-year period.

|

| |

(10)

| During February, 2015 Mr. Carney was granted options to purchase 50,000 shares of common stock of the Company. The fair value of the options at the time of grant was $16,562. They were granted to Mr. Carney for his performance as VP of Business Development during 2014 but were not part of a pre-defined bonus arrangement. In June, 2014, Mr. Carney was granted options to purchase 75,000 shares of common stock of the Company. The fair value of the options at the time of grant was $31,055. They were granted to Mr. Carney for his performance as VP of Business Development during 2013 but were not part of a pre-defined bonus arrangement.

|

Pensions

The Company does not have any pension plan ornor does it have any nonqualified defined contribution or anyand other nonqualified deferred compensation plans.

Potential Payments on Termination or Change in Control

In accordance with SEC rules, the following statements are based on the assumption that the triggering event took place on December 31, 2017.

In the event Mr. Zeitoun was terminated without Cause or he terminated for Good Reason, he would receive, in addition to the accrued obligations, (i) six monthsGrants of base salary ($175,000), (ii) one-half of bonus amounts not yet earned, and (ii) an amount equal to six months of COBRA payments. For 2017, Mr. Zeitoun was eligible to receive revenue bonus of up to $150,000 (which was earned) and performance bonuses of up to $200,000, which were not earned and in December, 2017, he was awarded $120,000 as a bonus for performance.

Mr. Carney. In the event Mr. Carney was terminated by the Company without Cause or he terminated his employment for Good Reason, he would receive (i) not less than two months of his base salary and (ii) continuation of benefits on the same terms as in effect immediately prior to the date of termination for a period of two months. Mr. Carney's base salary was $200,000.

Mr. Gleeson. In the event Mr. Gleeson terminated by the Company without Cause or he terminated his employment for Good Reason, he would receive (i) not less than two months of his base salary and (ii) continuation of benefits (including his family) on the same terms as in effect immediately prior to the date of termination for a period of two months. Mr. Gleeson's base salary was $250,000.

Plan-Based Awards

The following table lists theThere were no plan-based awards granted under the 2017 Incentive Plan.in 2018.

Name | | Grant date | | | All other option awards: Number of securities underlying options (#) | | | Exercise price of option awards ($/Share) | | | Grant date fair value of stock and option awards ($) | |

| | | | | | | | | | | | | | | | |

Andre Zeitoun | | | 8-18-17 | | | | 11,910,772 | | | | 0.06 | | | | 614,596 | |

Christopher Carney | | | 8-18-17 | | | | 4,780,550 | | | | 0.06 | | | | 246,676 | |

William Gleeson | | | 8-18-17 | | | | 3,748,939 | | | | 0.06 | | | | 193,471 | |

Outstanding Equity Awards at December 31, 20172018

The following table provides information on the holdings as of December 31, 20172018 of stock options granted to the named executive officers. This table includes unexercised and unvested option awards. Each equity grant is shown separately for each named executive officer

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2017 | | |

| OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2018 | | OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2018 |

Name | | Grant Date | | Number of Securities Underlying Unexercised Options: Exercisable | | Number of Securities Underlying Unexercised Options: Unexercisable | | Equity Incentive Plan Awards Number of Securities Underlying Unexercised Unearned Options | | Option Exercise Price | | Option Expiration Date | | | Grant Date | | Number of Securities Underlying Unexercised Options: Exercisable | | Number of Securities Underlying Unexercised Options: Unexercisable | | Equity Incentive Plan Awards Number of Securities Underlying Unexercised Unearned Options | | Option Exercise Price | | Option Expiration Date |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Andre Zeitoun | | 01-01-09 | | | 3,949,966 | | | -- | | | -- | | $ | 0.70 | | 01-01-19 | | | 01-01-09 | | | 3,949,966 | | | | — | | | | — | | | $ | 0.70 | | | 01-01-19 |

| | 02-08-11 | | | 1,742,792 | | | -- | | | -- | | $ | 0.83 | | 01-01-22 | | | 02-08-11 | | | 1,742,792 | | | | — | | | | — | | | $ | 0.83 | | | 01-01-22 |

| | 11-20-12 | | | 1,742,792 | | | -- | | | -- | | $ | 1.66 | | 01-01-23 | | | 11-20-12 | | | 1,742,792 | | | | — | | | | — | | | $ | 1.66 | | | 01-01-23 |

| | 05-11-16 | | | 321,123 | | | -- | | | -- | | $ | 0.24 | | 05-11-21 | | | 05-11-16 | | | 321,123 | | | | — | | | | — | | | $ | 0.24 | | | 05-11-21 |

| | 12-14-17 | | | 5,955,386 | | | 5,955,386 | | | -- | | $ | 0.06 | | 12-13-27 | | | 08-18-17 | | | 8,933,079 | | | | 2,977,693 | | | | — | | | $ | 0.06 | | | 12-13-27 |

Christopher T. Carney (2) | | 01-01-09 | | | 1,316,655 | | | -- | | | -- | | $ | 0.70 | | 01-01-19 | | | 01-01-09 | | | 1,316,655 | | | | — | | | | — | | | $ | 0.70 | | | 01-01-19 |

| | 02-08-11 | | | 580,930 | | | -- | | | -- | | $ | 0.83 | | 01-01-22 | | | 02-08-11 | | | 580,930 | | | | — | | | | — | | | $ | 0.83 | | | 01-01-22 |

| | 11-20-12 | | | 580,931 | | | -- | | | -- | | $ | 1.66 | | 01-01-23 | | | 11-20-12 | | | 580,931 | | | | — | | | | — | | | $ | 1.66 | | | 01-01-23 |

| | 06-10-14 | | | 75,000 | | | -- | | | -- | | $ | 0.84 | | 06-10-24 | | | 06-10-14 | | | 75,000 | | | | — | | | | — | | | $ | 0.84 | | | 06-10-24 |

| | 02-05-15 | | | 48,611 | | | 1,389 | | | -- | | $ | 0.68 | | 02-05-25 | | | 02-05-15 | | | 48,611 | | | | 1,389 | | | | — | | | $ | 0.68 | | | 02-05-25 |

| | 05-11-16 | | | 248,344 | | | -- | | | -- | | $ | 0.24 | | 05-11-21 | | | 05-11-16 | | | 248,344 | | | | — | | | | — | | | $ | 0.24 | | | 05-11-21 |

| | 07-06-16 | | | 500,000 | | | -- | | | -- | | $ | 0.16 | | 08-15-19 | | | 07-06-16 | | | 500,000 | | | | — | | | | — | | | $ | 0.16 | | | 08-15-19 |

| | 12-14-17 | | | 2,390,275 | | | 2,390,275 | | | -- | | $ | 0.06 | | 12-13-27 | | | 08-18-17 | | | 3,585,413 | | | | 1,195,137 | | | | — | | | $ | 0.06 | | | 12-13-27 |

William Gleeson | | 08-18-11 | | | 900,000 | | | -- | | | -- | | $ | 1.90 | | 08-18-21 | | | 08-18-11 | | | 900,000 | | | | — | | | | — | | | $ | 1.90 | | | 08-18-21 |

| | 11-20-12 | | | 72,406 | | | -- | | | -- | | $ | 1.66 | | 11-20-22 | | | 11-20-12 | | | 72,406 | | | | — | | | | — | | | $ | 1.66 | | | 11-20-22 |

| | 06-10-14 | | | 600,000 | | | -- | | | -- | | $ | 0.84 | | 06-10-24 | | | 06-10-14 | | | 600,000 | | | | — | | | | — | | | $ | 0.84 | | | 06-10-24 |

| | 05-11-16 | | | 248,344 | | | -- | | | -- | | $ | 0.24 | | 05-11-21 | | | 05-11-16 | | | 248,344 | | | | — | | | | — | | | $ | 0.24 | | | 05-11-21 |

| | 12-14-17 | | | 1,874,720 | | | 1,874,720 | | | -- | | $ | 0.06 | | 12-13-27 | | | 08-18-17 | | | 2,812,080 | | | | 937,360 | | | | — | | | $ | 0.06 | | | 12-13-27 |

Options Exercised and Stock Vested

None of the Named Executive Officers has exercised any options, SARs or similar instruments and none had any stock awards, vested or unvested.

Nonqualified Defined Contribution and Other Nonqualified Deferred Compensation Plans

There are no nonqualified defined contribution and other nonqualified deferred compensation plans

Part 4: Compensation Discussion and Analysis

Objectives and Strategy

The Company’s objectives are to develop a range of commercial applications for its halloysite clay-based and iron oxide-based products and to market those applications to industries seeking enhanced product functionality and to market its iron oxides for use in cement and other uses. We believe the successful marketing of such applications will generate material profits for the Company, which, in turn, will create significant value for its stockholders. To realize this objective, the Company must attract and retain individuals, including our Named Executive Officers (“Named Executive Officers” or“NEOs”), who possess the skill sets and experience needed to effectively develop and implement the business strategies and corporate governance infrastructure necessary to achieve commercial success.

Accordingly, compensation for the Named Executive Officers is designed to:

| ● | Attract, motivate, and retain qualified Named Executive Officers; |

| ● | Incentivize the Named Executive Officers to lead the Company to profitable operations and to increase stockholder value; |

| ● | Assure that over time a significant part of NEO compensation is linked to the Company’s long-term stock price performance, which aligns the Named Executive Officers’ financial interests with those of the Company’s stockholders |

| ● | Motivate the Named Executive Officers to develop long-term careers at the Company and contribute to its future prospects; and |

| ● | Permit the Named Executive Officers to remain focused on the development of the Company’s business in the midst of actual or potential change-in-control transactions. |

The Company does not have a policy concerning minimum ownership or hedging by officers of Company securities.

2016 vs. 2015; 2017 vs. 2016; 2018 vs. 2017

The compensation of the Named Executive Officers was significantly lower in 2016 than in 2015 due to the Board’s assessment of performance and ways to incentivize the NEOs as well as the Company’s actual and prospective condition.

The cash compensation in 2017 was higher in 2016 based on the Board’s assessment of NEO performance.. There was a large option granted designed to give the NEOs a significant long-term incentive.

2018 compensation was lower than 2017 primarily because no option grant was made in 2018.

Compensation of Mr. Zeitoun

Mr. Zeitoun was president and CEO of the Company from 2009 until September 9, 2019.

2016 Compensation

In order to assist the Compensation Committee in setting the 2016 compensation, the Compensation Committee hired CRI, the same compensation consultant that the Committee had used in connection with 2014 and 2015. At a meeting with the Compensation Committee on December 8, 2015, CRI presented a written report. The report indicated that CRI redefined the peer group used in connection with Mr. Zeitoun’s 2015 compensation.

The peer group was redefined to provide a “similar industry look.” The peer group companies for purposes of 2016 compensation: (i) were involved in specialty chemical manufacturing, biotech and pharmaceuticals, software, and mining; (ii) were national in geographic location with compensation adjusted to New York City; (iii) had a market capitalization between $20 million and $75 million; and (iv) had less than 50 employees.

The Compensation Consultant assumed that Mr. Zeitoun’s compensation would consist of a base salary of $500,000, a potential personal performance bonus of $200,000 and a potential revenue goal bonus of $100,000 for total direct compensation of $800,000.

Based on such assumptions measured against the peer group, the Compensation Consultant provided the following findings:

| | | | | | | | | Market

Range | | | Market Range | | | Relative |

| | | Actual | | | M/C | | | (+/-) | | | Low | | | High | | | Position |

| Base Salary | | $ | 500,000 | | | $ | 414,600 | | | | 10 | % | | $ | 373,100 | | | $ | 465,100 | | | Above |

| Total Cash Comp. | | $ | 800,000 | | | $ | 549,900 | | | | 20 | % | | $ | 439,900 | | | $ | 659,900 | | | Within |

| Total Direct Comp. | | $ | 800,000 | | | $ | 746,500 | | | | 25 | % | | $ | 559,900 | | | $ | 933,100 | | | Above |

After extensive discussion, the Board decided upon the following compensation package for Mr. Zeitoun in 2016. Salary: $350,000; bonus based on revenues: 4% of revenues up to a maximum bonus of $150,000; bonus if the Company became cash flow positive: $400,000; bonus based on personal goals: up to $100,000, which would be payable in options if the cash flow goal is not met.

The following table sets forth 2016 compensation compared to 2015. The reductions were based on the Board’s assessment of performance.

| | | 2016 Compensation | |

| | | 2016 salary | | | 2016 cash bonus based on revenue (1) | | | Total 2016 cash compensation (2)(3) | | | Reduction in cash compensation 2015 to 2016 | | 2016 option grant in lieu of salary | | | Bonus payable in options | | | Reduction in total compensation 2015 to 2016 |

| | | | | | | | | | | | | | | | | | | | |

| Zeitoun | | $ | 350,000 | | | $ | 150,000 | | | $ | 500,000 | | | $399,000 or 44% | | | | | | $ | 0 | | | $550,000 or 57% |

| Gleeson | | $ | 250,000 | | | | | | | $ | 250,000 | | | $87,500 or 26% | | | | | | $ | 0 | | | $125,000 or 33% |

| Carney | | $ | 181,250 | (4) | | | | | | $ | 181,250 | (4) | | $56,250 or 23% | | | $18,750 | (4) | | $ | 0 | | | $91,062 or 31% |

| 1. | Mr. Zeitoun’s revenue-related bonus was 4% of the first $4 million in revenues up to $150,000. The revenue goal was fully achieved. |

| 2. | Bonuses payable in cash, but if cash flow goal was not met, any bonus for achievement of personal goals would be payable in options. 80% of Zeitoun’s bonus was based on achievement of cash flow goal and 20% was based on achievement of personal goals. Others’ fractions were two-thirds for cash flow goal and one-third for personal goals. No bonus for achievement of personal goals will be paid, although no determination was made as to the achievement of personal goals. |

| 3. | The cash flow goal was not met and no cash bonus based on cash flow breakeven was paid. |

| 4. | Mr. Carney's salary was at the rate of $200,000 per year for first 7.5 months of 2016 and was at the rate of $150,000 for the final 4.5 months. Mr. Carney agreed to reduce his salary by $50,000 in the period from August 15, 2016 to August 15, 2017 in exchange for options that had a Black Scholes value of approximately $40,500. The options are three-year options, but in accordance with Mr. Carney’s offer to exchange cash for options, the number of options was based on $50,000 divided by the Black Scholes value of five-year options. |

2017 Compensation

On March 8, 2017, the Board determined that Mr. Zeitoun’s 2017 compensation is as follows: salary — $350,000; cash receipts bonus — 4% of monthly gross cash receipts, up to a maximum bonus of $150,000; revenue bonus — $100,000 if GAAP revenue exceeds $6 million; cash flow bonus — $100,000 if the Company is cash flow positive for 2017. The cash receipts bonus was earned. The revenue and cash flow bonuses were not earned.

On December 14, 2017, options to purchase 11,910,772 shares of common stock were issued to Mr. Zeitoun. The options are ten-year options and the exercise price is $0.06. Vesting conditions are as follows:

| ● | 25% of the options vested upon the closing of the sale of an aggregate of $600,000 of units (consisting of a share of Common Stock and a warrant to buy .25 of a share of Common Stock) at $0.04 per unit. |

| ● | 25% of the options vested upon the receipt of at least $900,000 from one or more of the following sources: sale(s) of Common Stock over and above $600,000, consideration for entering into licensing or similar agreement(s), and/or consideration for entering into agreement(s) relating to the sale or lease of minerals rights or entering into options or other agreements relating mineral rights. |

| ● | 25% of the options vested when the Company has toll processing arrangements with two toll processors of halloysite that, in management’s good faith belief, can process halloysite to the Company’s specifications. One of the agreements may be a back-up or standby arrangement. |

| ● | 8.3% of the options if EBITDA is positive over a period of twelve months. This vesting condition has not been satisfied. |

| ● | 8.3% of the options if EBITDA equals or exceeds $2 million over a period of twelve months. This vesting condition has not been satisfied. |

| ● | 8.4% of the options if EBITDA equals or exceeds $4 million over a period of twelve months. This vesting condition has not been satisfied. |

On December 7, 2017, the Board of Directors, on the recommendation of the Compensation Committee, granted to Mr. Zeitoun a bonus for service in 2017 of $120,000.

2018 Compensation

On the recommendation of the Compensation Committee, the Board determined Mr. Zeitoun’s 2018 compensation to be as follows. salary — $350,000. bonus — $75,000. The bonus was paid in 2019..

In reaching its decisions, the Compensation Committee and the Board took into account (i) the results of the most recent the Say-on-Pay vote (93%) in favor, which suggested that stockholders were generally favorable to the compensation scheme, (ii) the Company’s financial results and prospects for generating revenues and the need to conserve capital, which led to no increase in salary and the elimination of the 4% bonus, (iii) Mr. Zeitoun’s efforts in connection of the amendment of Series A and the Series 2023 notes and the sale of the waste piles for $4.5 million, which led to the bonus and (iv) the options granted in 2017, which provided sufficient lion-term incentive, so that no more long-term incentive was deemed necessary.

The Compensation Committee did not use a compensation consultant.

Compensation for Messrs. Gleeson and Carney

2016 Compensation

On December 9, 2016, the Board determined that the 2016 salary for Mr. Gleeson would be $250,000 and the 2016 Salary for Mr. Carney would be $200,000.

On March 9, 2016, the Board determined that 2016 bonus arrangements for Messrs. Carney, and Gleeson would be as follows:

Up to $25,000 based on achievement of personal goals and $50,000 if (i) the Statement of Cash Flow from Operations in the audited financial statements for the year ended December 31, 2016, adjusted for purposes of determining whether bonuses are payable to assume payment of all such bonuses is positive (based upon the business being operated in the ordinary course consistent with past practices, in the judgment of the Compensation Committee) and (ii) the Compensation Committee believes that it is more likely than not that cash flow from operations in 2017 will be positive. The cash flow goal was not met but the personal goals were met. In January, 2017, the Compensation Committee determined that the number of options would be determined by dividing $25,000 by $0.25 and the exercise price would be $0.25 per option. At the time of grant, the market price of the stock was $0.11 and the Black-Scholes value of the options was approximately $0.034 per option.

In July, 2016, Mr. Carney volunteered to exchange $50,000 of salary for options. Mr. Carney agreed to reduce his salary by $50,000 in the period from August 15, 2016 to August 1, 2017 in exchange for options that had a Black Scholes value of approximately $40,500. The options were three-year options, but in accordance with Mr. Carney’s offer to exchange cash for options, the number of options was based on $50,000 divided by the Black Scholes value of five-year options.

2017 Compensation

Mr. Carney’s 2017 compensation was as follows: salary — $150,000 per annum through August 15, 2017 and $200,000 per annum thereafter; revenue bonus — $25,000 if GAAP revenue exceeded $6 million; cash flow bonus — $25,000 if the Company was cash flow positive for 2017.

Mr. Gleeson’s 2017 compensation was as follows: salary — $250,000; revenue bonus — $25,000 if GAAP revenue exceeded $6 million; cash flow bonus — $25,000 if the Company was cash flow positive for 2017.

None of the bonuses were earned or paid.

On December 14, 2017, 4,780,550 options to purchase Common Stock were granted to Mr. Carney and 3,748,439 options were granted to Mr. Gleeson. The vesting conditions and the relevant definitions are the same as vesting conditions and definitions described above relating to the options granted to Mr. Zeitoun on December 14, 2017.

On December 7, 2017, the Board of Directors, on the recommendation of the Compensation Committee, granted to each of Mr. Carney and Mr. Gleeson a bonus for service in 2017 of $30,000, which was paid in 2018.

2018 Compensation

On the recommendation of the Compensation Committee, the Board determined 2018 compensation to be as follows: Mr. Carney: salary — $200,000; bonus — $20,000. The bonus was determined on January 31, 2019. Mr. Gleeson: salary — $250,000; bonus — $20,000. The bonus was determined on January 31, 2019.

In reaching its decisions, the Compensation Committee and the Board took into account (i) the results of the most recent the Say-on-Pay vote (93%) in favor, which suggested that stockholders were generally favorable to the compensation scheme, (ii) the Company’s financial results and prospects for generating revenues and the need to conserve capital, which led to no increase in salary, (iii) their efforts in connection of the amendment of Series A and the Series 2023 notes and the sale of the waste piles for $4.5 million, which led to the bonus and (iv) the options granted in 2017, which provided sufficient lion-term incentive, so that no more long-term incentive was deemed necessary.

The Compensation Committee did not use a compensation consultant.

Tax and Accounting Treatment of Compensation

Tax Deductibility Cap on Executive Compensation

The Compensation Committee is aware that Section 162(m) of the Internal Revenue Code treats certain elements of executive compensation in excess of $1 million a year as an expense not deductible by the Company for federal income tax purposes. Depending on the market price of the Company’s common stock on the date of exercise of options that are not performance-based, the compensation of certain executive officers in future years may be in excess of $1 million for purposes of Section 162(m). The Compensation Committee reserves the right to pay compensation that may be non-deductible to the Company if it determines that it would be in the best interests of the Company.

Tax and Accounting Treatment of Options

We are required to recognize in our financial statements compensation cost arising from the issuance of stock options. GAAP requires that such that compensation cost is determined using fair value principles (we use the Black-Scholes method of valuation) and is recognized in our financial statements over the requisite service period of an instrument. However, the tax deduction is only recorded on our tax return when the option is exercised. The tax benefit received at exercise and recognized in our tax return is generally equal to the intrinsic value of the option on the date of exercise.

Compensation of Policies and Practices as they relate to Risk Management

The Company does not believe that its compensation policies and practices (cash compensation and at-the-market or above-market five- and ten-year options without or without performance standards and with or without vesting schedules) are reasonably likely to have a material adverse effect on the Company as they relate to risk management practices and risk-taking incentives.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management. Based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in the Company’s proxy statement for the election of directors.

Mario Concha

John Levy

Robert Betz

There are no nonqualified defined contribution and nonqualified deferred compensation plans for Named Executive Officers.

Related Party Transactions26

Part 5 Information concerning Independent Registered Public Accountant

MaloneBailey LLP (“MaloneBailey”) was selected by our Board of Directors as the Company’s independent registered public accounting firm for the years ending December 31, 2018 and as our independent registered public accounting firm reviewed the interim financial statements for the three and nine months ended September 30, 2018.

The Board has selected MaloneBailey as the Company’ independent registered public accounting firm for the year ended December 31, 2019. The Board asks stockholders to ratify that selection. Although current law, rules, and regulations require the Board of Directors to engage and retain the Company’s independent auditor, the Board considers the selection of the independent auditor to be an important matter of stockholder concern and is submitting the selection of MaloneBailey LLP for ratification by stockholders as a matter of good corporate practice.

The affirmative vote of holders of a majority of the shares of Common Stock cast in person or by proxy at the meeting is required to approve the ratification of the selection of MaloneBailey LLP as the Company’s independent auditor for the current fiscal year. If a majority of votes cast does not ratify the selection of MaloneBailey LLP, the Board of Directors will consider the result a recommendation to consider the selection of a different firm. Representatives of the MaloneBailey LLP are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and such representatives are expected to be available to respond to appropriate questions.

EisnerAmper LLP (“EisnerAmper”), the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016 and December 31, 2017, was dismissed on October 4, 2018. The dismissal was approved by the Company’s Audit Committee.

The following table presents fees for services rendered by EisnerAmper for the years ended December 31, 2018 and 2017, respectively.

| | | January 1, 2018

through

October 4,

2018 | | | December 31,

2017 | |

| | | | | | | |

| Audit Fees (1) | | $ | 160,157 | | | $ | 143,500 | |

| Tax Fees | | | 7,500 | | | | 15,000 | |

| | | | | | | | | |

| Total | | $ | 167,657 | | | $ | 158,500 | |

| (1) | Audit fees includes fees for the audit of the annual financial statements and the review of the financial statements for the quarters and represent the aggregate fees paid for professional services including: (i) audits of annual financial statements, (ii) reviews of quarterly financial statements, (iii) S-1 filings and (iv) SEC comment letter responses. |

The following table presents fees for services rendered by MaloneBailey, the independent auditor for the audit of the Company’s annual consolidated financial statements for the year ended December 31, 2018.

| | | October 5, 2018

through

December 31,

2018 | |

| | | | |

| Audit Fees (1) | | $ | 67,500 | |

| Tax Fees | | | - 0 - | |

| | | | | |

| Total | | $ | 67,500 | |

| (1) | Audit fees includes fees for the audit if the annual financial statements and the review of the financial statements for the quarter ended September 30, 2018 and a deposit for work related to the Company’s 2018 audit. |

The audit reports of EisnerAmper on the financial statements of the Company as of and for the years ended December 31, 2017 and 2016 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle except, the audit reports for the years ended December 31, 2017 and 2016 include an explanatory paragraph about the existence of substantial doubt concerning the Company's ability to continue as a going concern.

During the years ended December 31, 2017 and 2016 and the interim period from January 1, 2018 through October 4, 2018, the Company had no disagreements with EisnerAmper on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of EisnerAmper, would have caused them to make reference to the subject matter of the disagreement(s) in connection with its reports on the financial statements for such years. During the years ended December 31, 2017 and 2016 and the interim period from January 1, 2018 through October 4, 2018, there were no “reportable events,” as that term is described in Item 304(a)(1)(v) of Regulation S-K, except as described herein. In Part I, Item 4 of the Company’s quarterly report on Form 10-Q for the fiscal quarter ended June 30, 2018, as filed with the Securities and Exchange Commission (the “SEC”) on August 20, 2018 (the “Second Quarter 2018 Form 10-Q”), management of the Company reported on its evaluation of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934) as of June 30, 2018, the end of the period covered by the Second Quarter 2018 Form 10-Q. The Second Quarter 2018 Form 10-Q stated that, based on such evaluation, the Company’s Chief Executive Officer (principal executive officer) and the Company’s Chief Financial Officer (principal financial officer) concluded that the Company’s disclosure controls and procedures were not effective because of the material weaknesses in the Company’s internal control over financial reporting described in Part II, Item 9A of the Company’s Form 10-K as of December 31, 2017, which was filed with the SEC on April 17, 2018 (the “2018 Form 10-K”).

Management identified the following material weaknesses as of December 31, 2017 as reported in the 2018 Form 10-K, which were still applicable as of June 30, 2018, and have caused management to conclude that as of December 31, 2017, their internal controls over financial reporting were not effective at the reasonable assurance level:

| ● | Insufficient segregation of duties, oversight of work performed and lack of compensating controls in the Company’s finance and accounting functions due to limited personnel; and |

| ● | The Company lacks a sufficient process for periodic financial reporting, including timely preparation and review of financial reports and statements. |

Because of the material weaknesses described in the 2018 Form 10-K, the Company’s Chief Executive Officer (principal executive officer) and Chief Financial Officer (principal financial officer) concluded that the Company did not maintain effective internal control over financial reporting as of December 31, 2017, based on criteria in Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

EisnerAmper discussed each of these matters with the Company’s management and the Audit Committee. The Company has authorized EisnerAmper to fully respond to the inquiries of Malone Bailey, the successor independent registered public accounting firm, concerning the subject matter of each reportable event referred to above.

During the fiscal years ended December 31, 2017 and 2016 and the interim period from January 1, 2018 through October 4, 2018, neither the Company, nor anyone on its behalf, consulted Malone Bailey regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the financial statements of the Company and no written report or oral advice was provided to the Company that Malone Bailey concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a “disagreement” (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a “reportable event” (as that term is defined in Item 304(a)(1)(v) of Regulation S-K).

| Policy on Board of Directors' Pre-Approval of Audit an Non-Audit Services of Independent Auditors |

|

The Audit Committee has adopted a policy for the pre-approval of all audit, audit-related, tax, and other services provided by the Company’s independent registered public accounting firm. The policy is designed to ensure that the provision of these services does not impair the registered public accounting firm’s independence. Under the policy, any services provided by the independent registered public accounting firm, including audit, audit-related, tax and other services must be specifically pre-approved by the Board of Directors. The Board of Directors does not delegate responsibilities to pre-approve services performed by the independent registered public accounting firm to management. For the fiscal year ended December 31, 2018, all services provided by the Company’s independent registered public accounting firm were pre-approved by the Board of Directors.

Part 6 Additional Important Information

Security Ownership of Certain Beneficial Owners and Management Ownership Tables

The following table sets forth, as of October 15, 2019, information regarding the beneficial ownership of our common stock with respect to each of the named executive officers, each of our directors, each person known by us to own beneficially more than 5% of the common stock, and all of our directors and executive officers as a group. Each individual or entity named has sole investment and voting power with respect to shares of common stock indicated as beneficially owned by such person, subject to community property laws, where applicable, except where otherwise noted. The percentage of common stock beneficially owned is based on 175,513,549 shares of common stock outstanding as of October 15, 2019 plus the shares that a person has a right to acquire within 60 days of October 15, 2019

| | | Number of

Shares of | | | Percentage

of Common | |

| | | Common Stock

Beneficially | | | Stock

Beneficially | |

| Name and Address (1) | | Owned (2) | | | Owned | |

| Mario Concha (3) (4) | | | 7,653,217 | | | | 4.2 | |

| Michael Barry (3) (18) | | | 0 | | | | * | |

| Robert Betz (3) (5) | | | 3,223,736 | | | | 1.8 | |

| John Levy (3) (6) | | | 2,760,801 | | | | 1.6 | |

| Michael Pohly (3) (19) | | | 0 | | | | * | |

| Geoffrey Scott (3) (17) | | | 8,785,210 | | | | 5.0 | |

| Ali Zamani (3) (8) | | | 2,829,338 | | | | 1.6 | |

| Alexandre Zyngier (3) (9) | | | 1,361,789 | | | | 1.0 | |

| Andre Zeitoun (10) (20) | | | 12,916,561 | | | | 6.9 | |

| Christopher T. Carney (11) (20) | | | 6,402,104 | | | | 3.5 | |

| William Gleeson (12) (20) | | | 4,632,830 | | | | 2.6 | |

| All Officers and Directors as a Group | | | 50,515,586 | | | | 23.9 | |

| IBS Capital, LLC (7) | | | 36,352,293 | | | | 19.4 | |

| Samlyn Capital, LLC (13) | | | 49,716,669 | | | | 23.1 | |

| Berylson Master Fund, L.P. (14) | | | 15,043,747 | | | | 8.0 | |

| James Berylson (14) | | | 16,316,747 | | | | 8.7 | |